|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

South Africa: #Guptaleaks - Will Heads Roll?

AfricaFocus Bulletin

June 6, 2017 (170606)

(Reposted from sources cited below)

Editor's Note

"The Guptas have until now escaped investigation from the state agencies because they

have purchased indemnity. You have to hand it to the Guptas; the way they went about

capturing the state is quite impressive. Not only did they buy the president and his

son, they targeted key people in government that could act as their minions. When

people were resistant to their agenda, they scouted for bootlickers and had them

appointed. They paid off people in the security agencies to make sure they would not

be bothered with criminal investigations." - Daily Maverick, June 5, 2017

In the United States and around the world, the news is dominated by the latest twist

in President Trump' express train to disaster, including the escalating revelations

of the Trump/Russia investigation. In South Africa, to comparatively little notice

around the world, the news is dominated by #Guptaleaks, as confidential emails

continue to emerge documenting the spiderweb of corruption linking President Zuma and

his team to a family of Indian businessmen who arrived in South Africa in 1993 and

quickly built up a business empire and political influence.

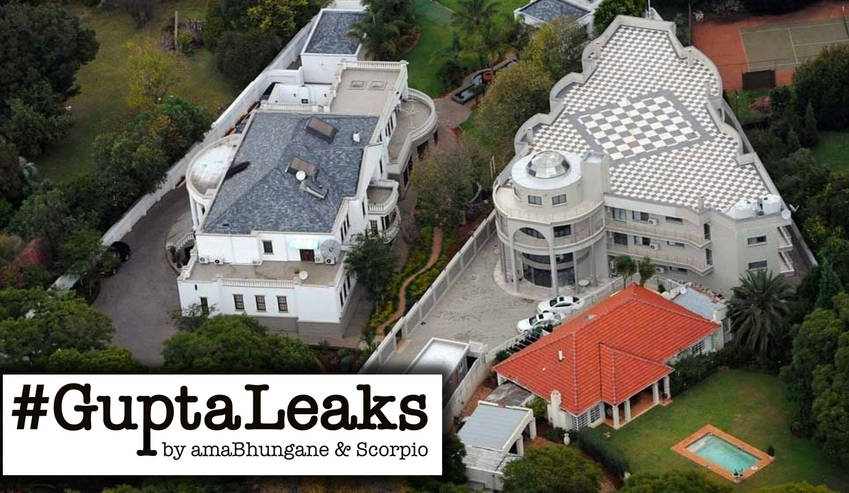

The Gupta family mansion in Saxonwold, Johannesburg

They also worked with businesses both in South Africa and around the world to manage

"illicit financial flows" of the profits to India, Dubai, and elsewhere. Recent

investigations, for example, found a mansion in Dubai purchased for President Zuma,

adjacent to a similar mansion for President Mugabe of Zimbabwe. Also of note is

that many of the companies involved are concentrated in the energy sector, in coal

and nuclear in particular.

It is difficult even for South Africans, or for international financial experts and

lawyers, to keep up with the wide cast of characters and intrigue that is being

exposed, and definitely impossible for those of us not intimately familiar with the

South African political and business scene and how international money laundering

works. A succinct summary is therefore impossible.

But the impact, although unpredictable, will be decisive for the future of South

Africa. To give a glimpse into the issue, AfricaFocus includes here one of the many

recent articles from the Daily Maverick and the AmaBhungane Centre for Investigative

Journalism, which have been leading the investigation, and brief excerpts from a

comprehensive analysis and report released by the State Capacity Research Project

last month.

For updates on #Guptaleaks, even though it has not yet caught the attention of world

media, the best strategy for those outside South Africa is a Google news search: as

of today, this search gives 90,600 hits, including 50,100 from websites in South

Africa.

For previous AfricaFocus Bulletins on South Africa, visit

http://www.africafocus.org/country/southafrica.php

For previous AfricaFocus Bulletins on corruption and illicit financial flows, visit

http://www.africafocus.org/intro-iff.php

++++++++++++++++++++++end editor's note+++++++++++++++++

#GuptaLeaks: What does email trove mean for Zuma and South Africa?

Ranjeni Mumusamy

Daily Maverick, June 5, 2017

http://www.dailymaverick.co.za - Direct URL: http://tinyurl.com/ycyhfc5y

Plausible deniability. President Jacob Zuma's greatest self-defence strategy is the

ability to manoeuvre to ensure that nothing can be directly pinned on him. From his

corruption case to the Nkandla upgrades to the ANC's losses at the polls to the

activities of the Gupta family, the president's excuse is either that these things

happened without his knowledge or have nothing to do with him. That is the big

problem with all the revelations so far from the massive tranche of leaked emails

implicating the Gupta family in state capture. Is there a smoking gun that directly

connects Zuma to the Guptas' illicit activities? And what are we supposed to do with

all this information?

Ever since the private plane full of wedding guests landed at Waterkloof Air Force

Base in April 2013, South Africans have known that the Guptas are a bunch of rotters

who have free run of the state. Between then and now, there has been a constant

stream of revelations about the extent of the Guptas' infiltration of the government

system, how they have bought political influence and taken over control from the ANC.

Before the leak of the Gupta emails, the evidence in the public domain was already

damning and sufficient to pursue prosecutions. Mcebisi Jonas, then a deputy minister

in government, confirmed publicly that he had been offered a R600 million incentive

to take the job of finance minister. The circumstances around the purchase of the

Optimum coal mine had corruption written all over it. The closure of the Guptas' bank

accounts after their transactions had been red flagged by the Financial Intelligence

Centre necessitated an investigation into money laundering.

The Guptas have until now escaped investigation from the state agencies because they

have purchased indemnity. You have to hand it to the Guptas; the way they went about

capturing the state is quite impressive. Not only did they buy the president and his

son, they targeted key people in government that could act as their minions. When

people were resistant to their agenda, they scouted for bootlickers and had them

appointed. They paid off people in the security agencies to make sure they would not

be bothered with criminal investigations.

The Guptas also knew how to service and keep their gallery of dancing marionettes

happy. Their compound in Saxonwold is like Vegas. Apart from Jonas, former government

spokesman Themba Maseko and former ANC MP Vytjie Mentor, whatever happened in

Saxonwold stayed in Saxonwold.

The parade of politicians and officials in government and state owned enterprises

keep the secrets of whatever is discussed and plotted behind those high walls. In the

case of minion without portfolio, Brian Molefe, he would rather conjure up a

Saxonwold shebeen than disclose his comings and goings to the Gupta compound.

An essential part of the state capture process was the Guptas' communications

operation. Through The New Age and ANN7, the Guptas ran their own propaganda

machinery. Through a partnership with the SABC, they not only set up a scheme to

channel large payments from state owned enterprises, they were also able to show off

their political connections including the president, Cabinet ministers and provincial

premiers. Then through the Bell Pottinger spin operation, they paid a range of useful

idiots to direct the national discourse, manipulate social media conversations and

attempt to demonise journalists.

The Guptas were thorough and tactical. They invested a lot of money in setting up

their patronage network of people who would do exactly what they wanted. For a long

time, their investment paid massive dividends.

Ordinary people have an odd fascination with audacious crimes. This is why people are

still in awe of the Great Train Robbery in 1963 when £2.6 million was stolen from a

Royal Mail train. The remake of the comedy heist film Ocean's Eleven raked in over

$450 million at the box office because the storyline of the most sophisticated,

elaborate casino heist in history continues to enthral people. In South Africa the

brazen 1996 R31 million SBV robbery was talked about for years afterwards and also

became a movie.

The Public Protector's State of Capture report, the South African Council of Churches

Unburdening Panel and the State Capacity Research Project by academics from four

universities all show how the Guptas went about gaining access to the state and

manipulating people and processes to amass wealth. Through their "silent coup", they

progressively sucked away power and influence from the ANC.

The information released from the email trove so far shows minute details of the

Guptas behind-the-scenes operations. From their manipulation of contracts to the

movement of money to a glimpse into their opulent lifestyles, the emails crank open

their world a little wider so that the rest of the world can gawk.

It is almost like a real life Ocean's Eleven with South Africa as the casino being

robbed – the Gupta brothers are ugly versions of George Clooney, Brad Pitt and Matt

Damon.

The emails reflect that central role of the president's son, Duduzane, in knitting

together the patronage network in exchange for the Guptas sponsoring his flamboyant

lifestyle. Raunchy attachments to his emails also reveal that he is a philanderer

with a taste for the highlife but that simply adds lewd unnecessary details to an

already messy story.

What ought to be the focus are the people involved, how the Guptas' representatives

pulled people's strings and greased their palms, how money was moved, how money was

stolen from the state and who aided and abetted them.

Revelations in the emails of how Gupta employees coached and wrote scripts for ANC

officials, including the ANC Youth League president shows that the political

discourse in the country is fake and driven by an agenda. It is now clear the radical

economic transformation narrative was fabricated to distract change the conversation

away from the corrupt activities of the patronage network.

But the email leak has yet to produce the smoking gun that links Zuma directly to the

Guptas activities. All that has been revealed has so far been circumstantial and

there is no firm evidence that Zuma intends relocating to Dubai. While Duduzane's

fingerprints are all over the state capture crime scene, there is nothing to indicate

that Zuma was aware or involved in his son's activities.

In this case, the sins of the son cannot be visited upon the father. But that does

not mean there is no case to answer. If Zuma were still accountable to the ANC, he

would have had to answer how he came to appoint people in his Cabinet that the Guptas

scouted. A proper criminal investigation would ask the same questions of Zuma.

Judge Hilary Squires pointed to a "mutually beneficial symbiosis" between Zuma and

his former financial advisor Schabir Shaik who was convicted of corruption. While

Zuma might have plausible deniability with regard to the emails, there is enough

evidence in the public domain for him to answer some hard questions in a credible

corruption investigation.

The avalanche of information released from the email tranche could cause a more

severe case of scandal fatigue amongst the South African public. There is too much to

process and the information simply confirms the extent to which the Guptas infested

the state in order to drain resources through numerous channels.

A judicial commission of inquiry might be the only way to process and test all the

information credibly. But because Zuma is charged with appointing it, a conflict of

interest is bound to arise both regarding which judge he appoints to head it and the

terms of reference. Zuma's application for a review of the Public Protector's report

that recommended that the Chief Justice name the judge means that the matter will be

dragged out for some time before the inquiry can be appointed.

The reliance on the judicial commission of inquiry however lets the police and the

National Prosecuting Authority (NPA) off the hook in pursuing the matter. The fact

that the Hawks and the NPA are not under public pressure to investigate and effect

prosecutions means that people accept that these institutions are lost cause and

under the thumb of Zuma and the Guptas.

The emails provide prima facie evidence of corruption, fraud, money laundering and

racketeering. These cannot be investigated and prosecuted by a judicial commission.

The full extent of the Guptas' activities have yet to be revealed, and possibly might

be as reports on the emails reel out. What is needed is an extensive criminal

investigation against the Guptas, Duduzane Zuma and others in their network.

Smoking gun or not, whoever is implicated must be investigated. And if there is

plausible deniability, let's hear it. In a court of law.

Betrayal of the Promise: How South Africa is Being Stolen

May 2017

State Capacity Research Project

Convenor: Mark Swilling

http://pari.org.za/ - Direct URL: http://tinyurl.com/yaphsta8

Executive Summary

This report suggests South Africa has experienced a silent coup that has removed the

ANC from its place as the primary force for transformation in society. Four public

moments define this new era: the Marikana Massacre on 16 August 2012; the landing of

the Gupta plane at Waterkloof Air Base in April 2013; the attempted bribing of former

Deputy Minister of Finance Mcebisi Jonas to sell the National Treasury to the shadow

state in late 2015; and the Cabinet reshuffle in March 2017. Resistance and capture

is what South African politics is about today.

Commentators, opposition groups and ordinary South Africans underestimate Jacob Zuma,

not simply because he is more brazen, wily and brutal than they expect, but because

they reduce him to caricature. They conceive of Zuma and his allies as a criminal

network that has captured the state. This approach, which is unfortunately dominant,

obscures the existence of a political project at work to repurpose state institutions

to suit a constellation of rent-seeking networks that have been constructed and now

span the symbiotic relationship between the constitutional and shadow state. This is

akin to a silent coup. This report documents how the Zuma-centred power elite has

built and consolidated this symbiotic relationship between the constitutional state

and the shadow state in order to execute the silent coup.

At the nexus of this symbiosis are a handful of the same individuals and companies

connected in one way or another to the Gupta- Zuma family network. The way that this

is strategically coordinated constitutes the shadow state. Well-placed individuals

located in the most significant centres of state power (in government, SOEs and the

bureaucracy) make decisions about what happens within the constitutional state.

Those, like Jonas, Vytjie Mentor, Pravin Gordhan and Themba Maseko who resist this

agenda in one way or another are systematically removed, redeployed to other

lucrative positions to silence them, placed under tremendous pressure, or hounded out

by trumped up internal and/or external charges and dubious intelligence reports. This

is a world where deniability is valued, culpability is distributed (though

indispensability is not taken for granted) and where trust is maintained through

mutually binding fear. Unsurprisingly, therefore, the shadow state is not only the

space for extra-legal action facilitated by criminal networks, but also where key

security and intelligence actions are coordinated.

It has been argued in this report that from about 2012 onwards the Zuma-centred power

elite has sought to centralise the control of rents to eliminate lower-order, rentseeking

competitors. The ultimate prize was control of the National Treasury to gain

control of the Financial Intelligence Centre (which monitors illicit flows of

finance), the Chief Procurement Office (which regulates procurement and activates

legal action against corrupt practices), the Public Investment Corporation (the

second largest shareholder on the Johannesburg Securities Exchange), the boards of

key development finance institutions, and the guarantee system (which is not only

essential for making the nuclear deal work, but with a guarantee state entities can

borrow from private lenders/banks without parliamentary oversight). The cabinet

reshuffle in March 2017 has made possible this final control of the National

Treasury.

The capture of the National Treasury, however, followed five other processes that

consolidated power and centralised control of rents:

- The ballooning of the public service to create a compliant politically-dependent,

bureaucratic class.

- The sacking of the ‘good cops' from the police and intelligence services and their

replacement with loyalists prepared to cover up illegal rent seeking (with some

forced reversals, for example, Robert McBride)

- Redirection of the procurement-spend of the SOEs to favour those prepared to deal

with the Gupta-Zuma network of brokers (those who are not, do not get contracts, even

if they have better BEE credentials and offer lower prices).

- Subversion of Executive Authority that has resulted in the hollowing out of the

Cabinet as South Africa's pre-eminent decision-making body and in its place the

establishment of a set of ‘kitchen cabinets' of informally constituted elites who

compete for favour with Zuma in an unstable crisis-prone complex network;

- The consolidation of the Premier League as a network of party bosses, to ensure

that the National Executive Committee of the ANC remains loyal.

At the epicentre of the political project mounted by the Zuma-centred power elite is

a rhetorical commitment to radical economic transformation. Unsurprisingly, although

the ANC's official policy documents on radical economic transformation encompass a

broad range of interventions that take the National Development Plan as a point of

departure, the Zuma-centred power elite emphasises the role of the SOEs, particularly

their procurement spend. Eskom and Transnet, in turn, are the primary vehicles for

managing state capture, large-scale looting of state resources and the consolidation

of a transnationally managed financial resource base, which in turn creates a

continuous source of self-enrichment and funding for the power elite and their

patronage network.

In short, instead of becoming a new economic policy consensus, radical economic

transformation has been turned into an ideological football kicked around by

factional political players within the ANC and the Alliance in general who use the

term to mean very different things.

The alternative is a new economic consensus. Since 1994 there has never been an

economic policy framework that has enjoyed the full support of all stakeholders. A

new economic consensus would be a detailed programme of radical economic

transformation achieved within the constitutional, legislative and governance

framework. The focus must be a wide range of employment- and livelihood-creating

investments rather than a few ‘big and shiny' capital-intensive infrastructure

projects that reinforce the mineral-energy-complex. For this to happen, an atmosphere

of trust conducive for innovation- oriented partnerships between business,

government, knowledge institutions and social enterprises is urgently required. None

of this is achievable, however, until the shadow state is dismantled and the key

perpetrators of state capture brought to justice.

Jacob Zuma comes to power

Jacob Zuma was elected ANC President at the Polokwane conference in December 2007. In

July 2008, Duduzile Zuma, his 26-year-old daughter, was asked to join the board of

the Gupta technology company Sahara Computers (she resigned in 2010). Duduzane, her

twin brother, was also taken under the Gupta's wing and joined Sahara, though the

date is unclear. The twins were two of the five children of Jacob Zuma and Kate

Mantsho, who committed suicide in 2000. Zuma is reported as having always felt

particularly concerned about their wellbeing.

...

Origins of the nuclear deal

In May 2010, ... the media broke a story that Gupta-owned company Oakbay Resources

and Energy, together with minority shareholders, including Duduzane Zuma's BEE

vehicle, Mabengela Investments, was the buyer of Toronto-listed Uranium One's

Dominion mine in Klerksdorp. Oakbay paid $37 million (about R280 million). Mabengela

Investments is reportedly jointly controlled by Duduzane Zuma and Gupta brother

Rajesh (Mabengela is named after a hill overlooking President Jacob Zuma's Nkandla

homestead).

At the time that Oakbay bought Dominion – later named Shiva Uranium – media

speculation was rife that President Zuma had intervened a month earlier, in April

2010, to extend the tenure of then Public Investment Corporation head Brian Molefe to

facilitate negotiations towards a large investment in the project. The Presidency

denied these allegations, saying that the president's son was, "a businessman in his

own right", and did not need his father's help.

The interesting thing was that Dominion had been on ‘care and maintenance' since 2008

with Uranium One chief executive Jean Nortier saying: "We had to close that chapter;

we certainly weren't going to try to bring Dominion back into production — it

certainly was going to require too much capital." Bringing Dominion back to full

production was projected to cost far more than the $37 million purchase price,

according to media reports. ...

... in retrospect, the Zuma power elite had their sights set on a large-scale nuclear

programme that would create a new and lucrative market for uranium. Molefe, then CEO

of the Public Investment Corporation, seems to enter the story at this point in what

may have been his first act to ingratiate himself with the Zuma group after being

identified for so long as an ‘Mbeki man'. Although he denied having a hand in the

Gupta's Uranium One deal, there seem to be too many unexplainable coincidences.

The timing is indicative. According to amaBhungane, Molefe's last day as CEO of the

Public Investment Corporation would have been 12 April 2010, two days before the

Dominion transaction was closed.

However, his contract was extended for three months, to the reported irritation of

senior ANC and alliance officials. At the time, the Sunday Times reported that Jacob

Zuma was "understood to have phoned a senior official in the finance ministry to ask

that Molefe remain in the job."

According to amaBhungane, company registration documents show that Atul Gupta and

Duduzane Zuma took over as directors of the Dominion holding company on 14 April, the

day the sale was finalised. If, as alleged in media reports, Molefe was involved in

negotiations to commit Public Investment Corporation funding, his departure at that

crucial time might have compromised the negotiations. The investment committee

rejected the deal as being too risky, but the Industrial Development Corporation

provided the loan.

Guptas go transnational

In December 2014, it emerged that the Guptas allegedly make use of the global

financial system in what law enforcement circles refer to as ‘shadow

transnationalism' – an essential element for brokers facilitating large-scale

criminality to "navigate resources to international clearing hubs where they enter

the legitimate trade and accrue value to the members of the network". 61 The deal

involved the listing of Oakbay and a R100 million Industrial Development Corporation

loan, given to the company in 2010 to buy the Shiva Uranium mine.

On 28 November 2014, the Gupta company, Oakbay Resources and Energy, listed on the

Johannesburg Stock Exchange. Atul Gupta, his wife Chetali, brother Rajesh and sisterin

-law Arti own about 80 percent of the company. Oakbay's main asset, and the main

driver of its value, was its subsidiary Shiva Uranium.

But, according to an amaBhungane investigation and documents observed by this group

of researchers, the Guptas appear to have significantly inflated Oakbay's market

value above the inherent value given at the time, with the help of a Gupta associate

in Singapore. This allowed them to pay off their Industrial Development Corporation

loan, but it also meant that the state- owned entity lost out when the Oakbay share

price market corrected. At the time that this story broke, Oakbay's financials showed

that it had not been able to maintain profitability at Shiva. According to the 2010

purchase agreement for the mine, the entire debt should have been repaid by April

2013. But Oakbay's financials stated that, by the end February 2014, only R20 million

had been paid and the debt with interest had grown to R399 million.

In June 2014, after negotiations with the Industrial Development Corporation, they

agreed to restructure the debt, including a new repayment schedule that would end in

2018. As part of this agreement, and as Oakbay's pre-listing statement showed, the

Industrial Development Corporation would take a small stake (about 3.6 percent) in

Oakbay in lieu of the debt. Oakbay's interim financials at the end of August 2014

gave the company a net asset value of about R4.6 billion, which translated into an

asset value of R5.74 a share, according to amaBhungane. 62 This dropped to R4.84 a

share once substituted with the lower value put on them by a valuer appointed as part

of the listing requirements.

Despite this, Oakbay listed at R10 a share, which was nearly double the underlying

asset value. This was significant, because it was this R10 ‘market' value, minus a 10

percent discount, at which the Industrial Development Corporation got shares (its 3.6

percent) in lieu of Oakbay's outstanding debt. When compared with the underlying

value of R5.74 provided by Oakbay's own financials, or to the adjusted R4.84, the

Industrial Development Corporation ultimately gave Oakbay a discount of between R93-

R119 million (essentially cash in hand to clear their debt – an ultimate loss to

South Africa given that these are state resources).

The question was how Oakbay allegedly inflated its market value. The answer,

according to an AmaBhungane investigation, lay in Singapore, where a company called

Unlimited Electronic & Computers paid R10 a share in a private placement shortly

before the listing acquiring 2.3 percent of the company. Unlimited Electronic &

Computers, according to amaBhungane, is owned by Kamran ‘Raj' Radiowala, who has been

associated with the Guptas since about 2006. Online company registration data cited

by amaBhungane has him being appointed managing director of an Indian electronics

distribution company, SES Technologies, in 2007. SES was co-owned by the Guptas'

South African business Sahara Computers, and its board included Ashu Chawla, one of

their associates in South Africa. The SES chief operating officer for some time was

George van der Merwe, who held the same position at Sahara and who was the former CEO

of Oakbay.

... and move their money offshore

In July 2015, the first detailed analysis of how the Guptas move the proceeds of

their business activities was presented by amaBhungane. Their operation centres on a

Gupta-controlled shell company called Homix. Shell companies, by virtue of the

ownership anonymity that they provide, are classic vehicles for money laundering and

other illicit financial activity. According to the Financial Crimes Enforcement

Network:

The term 'shell company' generally refers to limited liability companies and other

business entities with no significant assets or ongoing business activities. Shell

companies – formed for both legitimate and illicit purposes – typically have no

physical presence other than a mailing address, employ no one, and produce little to

no independent economic value.

Between 2014 and 2015, Homix moved R166 million through its accounts, primarily from

five companies. As is characteristic of shell companies, Homix has no discernible

office infrastructure or staff commensurate with a company processing such large sums

of money, according to amaBhungane, which visited its premises. Bank records obtained

by amaBhungane, and other bank records observed by this group of researchers, show

that as the money came into the Homix bank account, it immediately went straight out

again, to an equally obscure entity called Bapu Trading.

This pattern displays the three classic money laundering characteristics of

placement, layering and integration where placement is the movement of cash from its

source (the five companies), followed by placing it into circulation (layering)

through, among other mechanisms, financial institutions and other businesses (for

example Homix), and finally integration, the purpose of which is to make it more

difficult to detect and uncover by law enforcement.

...

Enter Mosebenzi Zwane

On 22 September 2015, President Zuma – reportedly to the surprise of even top members

of the ANC – announced that he would fill a six-month-old vacancy in his Cabinet with

the relatively unknown Mosebenzi Zwane, who he appointed to the critically important

mineral resources portfolio. Zwane's appointment as a minister escalated him from a

backbencher member of parliament who previously had been in the Free State provincial

government. He had no experience in mining or in a national portfolio position. His

origins in the Free State suggest that this was a move orchestrated by Ace Magashule.

In April 2016, seven months after Zwane's appointment, Gupta-owned Tegeta

Exploration & Resources acquired Optimum coal mine from Glencore. Duduzane Zuma owns

12.8 percent of Tegeta. Various members of the Gupta family own 36 percent of the

company, Gupta associate Salim Essa owns 21.5 percent and just over 20 percent is

owned by two off-shore companies registered in the United Arab Emirates, for which

ownership details are unavailable.

The Guptas bought Optimum from Glencore for R2.2 billion. The purchase was, however,

riddled with allegations of political interference and bias towards sectional

business interests, namely the Guptas. It is now widely accepted that Eskom

prejudiced Glencore, by using the full might of the law, to force Optimum into

business rescue to enable Tegeta to buy the company on highly favourable terms.

Former Public Protector Madonsela's State of Capture report found that Eskom may have

repeatedly broken the law to accommodate Tegeta. ...

In December 2015, while Van der Riet and Ramavhona were still on suspension and

Tegeta's purchase of Optimum was being finalised, Tegeta was granted a short-term

contract to supply 255 000 tons of coal a month to another power station, Arnot. It

subsequently emerged that the award of this contract resulted in Eskom extending

Tegeta a R586 million (ex VAT) upfront payment for this coal supply, six hours after

the Gupta company's banks refused them a R600 million loan to close the Optimum Coal

deal. The State of Capture report concluded that the payment was likely pushed

through to plug a R600 million hole in the R2 billion the Guptas needed to buy

Optimum. At a special late-night tender committee meeting on 11 April 2016, Eskom

executives, led by Brian Molefe, agreed to transfer R586 million to Tegeta – money

that was then used, two days later, to help pay for the purchase of Optimum.

...

The draft findings of a year-long National Treasury investigation concluded in April

2017 that the prepayment should be treated as a loan. According to the investigation:

"The advance payment of R659 558 079 should be regarded as a loan because there is no

evidence that Optimum Coal Mine or Tegeta Exploration and Resources used the funds to

procure any equipment for increasing the volume of the coal or further processing the

coal," adding that the interest should be recovered from Tegeta or the Eskom

officials involved. The draft report also recommended that a forensic audit firm be

appointed to "investigate why Eskom gave and continues to give preferential treatment

to Tegeta ... by not enforcing key conditions of the Coal Supply Agreement".

In August 2016, Eskom acting CEO Matshela Koko, gave Tegeta a R7 billion coal

contract without a tender, ignoring warnings from the National Treasury that such a

contract could be irregular. Under the contract, Tegeta's Koornfontein Mines would

deliver 2.4 million tons of coal a year at R414 a ton to Komati power station, 40

kilometres south of Middelburg. The contract was due to run until August 2023.

However, two months after the seven-year contract was signed, Eskom's board decided

to mothball the power station. This means that Eskom will either need to buy Tegeta

out of the contract or assume the cost of transporting the coal to another power

station, at least 50 kilometres away.

AfricaFocus Bulletin is an independent electronic publication providing reposted

commentary and analysis on African issues, with a particular focus on U.S. and

international policies. AfricaFocus Bulletin is edited by William Minter.

AfricaFocus Bulletin can be reached at africafocus@igc.org. Please write to this

address to suggest material for inclusion. For more information about reposted

material, please contact directly the original source mentioned. For a full archive

and other resources, see http://www.africafocus.org

|