|

Algeria

Angola

Benin

Botswana

Burkina Faso

Burundi

Cameroon

Cape Verde

Central Afr. Rep.

Chad

Comoros

Congo (Brazzaville)

Congo (Kinshasa)

Cτte d'Ivoire

Djibouti

Egypt

Equatorial Guinea

Eritrea

Ethiopia

Gabon

Gambia

Ghana

Guinea

Guinea-Bissau

Kenya

Lesotho

Liberia

Libya

Madagascar

Malawi

Mali

Mauritania

Mauritius

Morocco

Mozambique

Namibia

Niger

Nigeria

Rwanda

São Tomé

Senegal

Seychelles

Sierra Leone

Somalia

South Africa

South Sudan

Sudan

Swaziland

Tanzania

Togo

Tunisia

Uganda

Western Sahara

Zambia

Zimbabwe

|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

South Africa/USA: Inequality is Extreme and Still Rising

AfricaFocus Bulletin

January 15, 2018 (180115)

(Reposted from sources cited below)

|

Editor's Note

"I came here because of my deep interest and affection for a land settled by the

Dutch in the mid-seventeenth century, then taken over by the British, and at last

independent; a land in which the native inhabitants were at first subdued, but

relations with whom remain a problem to this day; a land which defined itself on a

hostile frontier; a land which has tamed rich natural resources through the energetic

application of modern technology; a land which once imported slaves, and now must

struggle to wipe out the last traces of that former bondage. I refer, of course, to

the United States of America." - Robert F. Kennedy, University of Cape Town, June 6,

1966

More than 50 years after Robert Kennedy's speech in Cape Town, there have been

many victories in the fight for political rights and against racial discrimination

in both South Africa and the United States. The sacrifices and victories of those

decades should not be discounted.

Nevertheless, despite the advance of many African Americans and Black South Africans

into positions of power and wealth, the inequality inherited from that history

remains deeply imprinted in the society and the economy. Its effects are felt not

only in the explicit racial inequalities that still exist, but also in the

ideologies rationalizing inequality more generally and legitimizing structural

inequalities as the allegedly deserved outcome of individual achievement.

The World Inequality Report, just released, documents with the best data available on the

trends of inequality at global and national levels, a necessary but of course insufficient

step in finding remedies to reverse the trend of increasing inequality and to repair

the damages still felt from historical inequities.

This AfricaFocus Bulletin contains excerpts from the chapters on South Africa

and the United States from the new World Inquality Report. Excerpts from the

executive summary of the report appear in another AfricaFocus Bulletin sent out

today and available at http://www.africafocus.org/docs18/ineq1801.php.

For previous AfricaFocus Bulletins on South Africa, visit

http://www.africafocus.org/country/southafrica.php

++++++++++++++++++++++end editor's note+++++++++++++++++

|

World Inequality Report 2018

Trends in global income inequality

For the full report, database, and extensive additional background information, visit

http://wir2018.wid.world/

2.12: Income inequality in South Africa

- South Africa stands out as one of the most unequal countries in the world. In 2014,

the top 10% received 2/3 of national income, while the top 1% received 20% of

national income.

- During the twentieth century, the top 1% income share was halved between 1914 and

1993, falling from 20% to 10%. Even if these numbers must be qualified, as they are

surrounded by a number of uncertainties, the trajectory is similar to that of other

former dominions of the British Empire, and is partly explained by the country's

economic and political instability during the 1970s and 1980s.

- During the early 1970s the previously constant racial shares of income started to

change in favor of the blacks, at the expense of the whites, in a context of

declining per capita incomes. But while interracial inequality fell throughout the

eighties and nineties, inequality within race groups increased.

- Rising black per capita incomes over the past three decades have narrowed the

interracial income gap, although increasing inequality within the black and

Asian/Indian population seems to have prevented any decline in total inequality.

- Since the end of Apartheid in 1994, top-income shares have increased

considerably. In spite of several reforms targeting the poorest and fighting the

segregationist heritage, race is still a key determinant of differences in income

levels, educational attainment, job opportunities and wealth.

South Africa's dual economy is among the most unequal in the world

South Africa is one of the most unequal countries in the world. In 2014, the top 10%

of earners captured two thirds of total income. This contrasts with other high-income

inequality countries such as Brazil, the United States and India where the top 10% is

closer to 5055% of national income. However, unlike other highly unequal countries,

the divide between the top 1% and the following 9% in South Africa is much less

pronounced than the gap between the top 10% and the bottom 90%. Otherwise said, in

terms of top income shares, South Africa ranks with the most unequal Anglo-Saxon

countries, but, at the same time, there is less concentration within the upper income

groups, mostly composed by the white population. The average income among the top 1%

was about four times greater than that of the following 9% in 2014 (for comparative

purposes, the top 1% in the United States earn seven times more than the following

9%), while average income among the top 10% was more than seventeen times greater

than the average income of the bottom 90% (it is eight times more in the United

States). It is then only logical that the income share of the top 1% is high,

capturing 20% of national income, though this is not the largest share in the world.

The South African "dual economy" can be further illustrated by comparing South

African income levels to that of European countries. In 2014, the average national

income per adult among the richest 10% was 94 600, at purchasing power parity, that

is, comparable to the average for the same group in France, Spain or Italy. But

average national income of the bottom 90% in South Africa is close to the average

national income of the bottom 16% in France. In light of these statistics, the

recently debated emergence of a so-called middle class is still very elusive. Rather,

two societies seem to coexist in South Africa, one enjoying living standards close to

the rich or upper middle class in advanced economies, the other left behind.

Inequality has decreased from the unification of South Africa to the end of

apartheid

South Africa is an exception in terms of data availability in comparison with other

African countries. The period for which fiscal data are available starts in 1903 for

the Cape Colony, seven years before the Union of South Africa was established as a

dominion of the British Empire, and ends in 2014, with some years sporadically

missing, and noticeably an eight- year interruption following the end of apartheid in

1994. As is often the case with historical tax data series, only a very small share

of the total adult population was eligible to pay tax in the first half of the

twentieth century. Therefore, the fiscal data from which we can estimate top-income

shares allows us to track the top 1% income share since 1913, but only cover the top

10% of the population from 1963 (with a long interruption between 1971 and 2008).

With important short run variations, the evolution of income concentration over the

19131993 period seems to follow a very clear long-term trend. The income share of

the richest 1% was more than halved between 1913 and 1993, falling from 22% to

approximately 10%. Not only did the income share attributable to the top 1% decrease,

but inequality within this upper group was also reduced. Indeed, the share of the top

0.5% fell more quickly than the share of the next 0.5% (from percentile 99 to

percentile 99.5). Consequently, while the top 0.5% represented about 75% of the top

1% in 1914, by the end of the 1980s, their representative proportion fell to 60%.

Despite the extreme social implications of the first segregationist measures that

were implemented in the early 1910s, these policies did not lead to large increases

in income concentration among the top 1%. This was also a time in which South Africa

progressively developed its industrial and manufacturing sector, enjoying notable

accelerations in the 1930s that were to the benefit of the large majority of the

population. Aside from a brief fall during the Great Depression, average real income

per adult then increased steadily. Following a trend similar to other former

Dominions of the British Empire (Australia, Canada and New Zealand) inequality

decreased significantly in South Africa from 1914 to the beginning of the the Second

World War, despite some short-run variations in the late 1910s: the income share of

the top 1% fell from 22% to 16%.

During the Second World War, national average continued to follow its previous trend,

but the average real income of the richest 1% took off. As a consequence of the

demand shock during the war, the agricultural export prices boomed, the manufacturing

sector more than doubled its output between 1939 and 1945, and profits for the

foundry and engineering industries increased by more than 400%. However, the wage

differential between skilled/white and unskilled/black workers remained extremely

large. As C.H. Feinstein described, "black workers [were] denied any share of the

growing income in the new economy they were creating." The fact that the peak in the

income share of the top 1%--as high as 23% in 1946--was concomitant with the war

effort thus seems essentially due to a brief enrichment of the upper class.

In contrast, income growth in the 1950s was more inclusive, as average real income

per adult increased by 29% between 1949 and 1961, while the average real income of

the top 1% slightly decreased. By 1961 the income share of the top 1% had fallen to

around 14%. In the 1960s, both averages grew approximately at the same rate such that

inequality remained relatively constant. Following 60 years of successive increases,

national average income was almost four times greater by the early 1970s than in

1913. Inequality resumed its downward sloping trend from 1973, but this also marked a

period of overall income growth stagnation in South Africa until 1990 that culminated

in a three-year recession.

For the first time in the previous 90 years, gold output started falling. Richer

seams were exhausted and extraction costs increased rapidly. The industry that was

once the engine of the economy started to weaken. Increases in oil prices and other

commodities accelerated inflation dramatically, averaging about 14% per year between

1975 and 1992. In the 1980s, international sanctions and boycotts were placed on

South African trade as a response to the apartheid regime, adding further pressure to

that created by domestic protests and revolts, and contributed to the destabilization

of the regime in place. White dominance was challenged on both economic and political

grounds, to which the ruling government progressively made concessions, recognizing

trade unions and the right to bargain for wages and conditions; this could partly

explain why the average real income per adult of the top 1% decreased faster than the

national average.

The progressive policies implemented after apartheid were not sufficient to

counter a profoundly unequal socio-economic structure

There are no fiscal data to estimate top-income shares for the eight years that

followed 1993. However, joining up the data points to the next available figure in

2002 suggests that income inequality has increased sharply between the end of

apartheid and the present, even if the magnitude of the increase must be taken with

caution, as the estimates in these two periods may not be totally comparable. The

income share of the top 1% increased by 11 percentage points from 1993 to 2014. Part

of the increase from 1993 to 2002 should come from changes in the tax code. In

particular, before 2002, capital gains were totally excluded, which is very likely to

downward bias the share of top-income groups. Also, the tax collection capabilities

seem to have increased substantially in the last years. That being said, household

survey data for the years 1993, 2000 and 2008 research has demonstrated that

inequality increased significantly during the period for which we have no fiscal

data.

At first, it might seem puzzling that the abolishment of a segregationist regime was

followed by an aggravation of economic inequality. The establishment of a multiracial

democracy, with a new constitution and a president of the same ethnic origin

as the majority of the population, did not automatically transform the inherited

socio-economic structure of a profoundly unequal country. Interracial inequality did

fall throughout the eighties and nineties, but inequality within race groups

increased: rising black per capita incomes over the past three decades have narrowed

the black-white income gap, although increasing inequality within the black and

Asian/Indian population seems to have prevented any decline in aggregate inequality.

In explaining these changes scholars agree in that the labor market played a dominant

role, where a rise in the number of blacks employed in skilled jobs (including civil

service and other high-paying government positions) coupled with increasing mean

wages for this group of workers.

Since 1994, several redistributive social policies have been implemented and/or

extended, among which important unconditional cash transfers targeting the most

exposed groups (children, disabled and the elderly). At the same time, top marginal

tax rates on personal income were kept relatively high and recently increased to 45%.

However, in spite of these redistributive policy efforts, surveys consistently show

that top-income groups are still overwhelmingly white. Other studies further

demonstrate that such dualism is itself salient along other key dimensions such as

unemployment and education. Furthermore wealth, and in particular land, is still very

unequally distributed. In 1913, the South African parliament passed the Natives Land

Act which restricted land ownership for Africans to specified area, amounting to only

8% of the country's total land area, and by the early 1990s, less than 70 000 white

farmers owned about 85% of agriculture land. Some land reforms have been implemented,

but with seemingly poor results, and it is likely that the situation has not improved

much since, although precise data about the recent distribution of land still needs

to be collected.

Given this socio-economic structure, the interruption of the international boycotts

in 1993 might have more directly favored a minority of high skilled and/or richer

individuals who were able to benefit from the international markets, which therefore

contributed to increase inequality. This hypothesis would also explain the fact that

income inequality in South Africa did not increase in the 1980s, while boycotts were

put in place, contrary to other former Dominions (New Zealand, Canada and Australia)

despite the country having so far followed a similar trend. Furthermore, the

implementation of the Growth, Employment and Redistribution (GEAR) program in 1996,

which consisted of removing trade barriers, liberalizing capital flows and reducing

fiscal deficit might also have contributed, at least in the short run, to enrich the

most well off while exposing the most vulnerable, in part by increasing returns to

capital over labor and to skilled workers over unskilled workers.

The rapid growth experienced from the early 2000s until the mid-2010s was essentially

driven by the rise in commodity prices and was not accompanied with significant job

creation as the government hoped it would. The income share of the top 1% grew from

just less than 18% in 2002 to over 21% in 2007, then decreased by about 1.5

percentage points and increased again in 20122013 as prices reached a second peak.

The fact that these variations closely mirror the fluctuation in commodity prices

suggest that a minority benefiting from resource rents could have granted themselves

a more than proportional share of growth.

Lastly, it should be stressed that the top 1% only represents a small part of the

broader top 10% elite which is mostly white. While the share of income held by the

top 1% is relatively low as compared to other high inequality regions such as Brazil

or the Middle East, the income share of the top 10% group is extreme in South Africa.

The historical trajectory of the top 10% group may be different to that of the top

1%--potentially with less ups and downs throughout the 20th century. Unfortunately at

this stage, historical data on the top 10% group does not go as far back in time as

for the top 1% group."

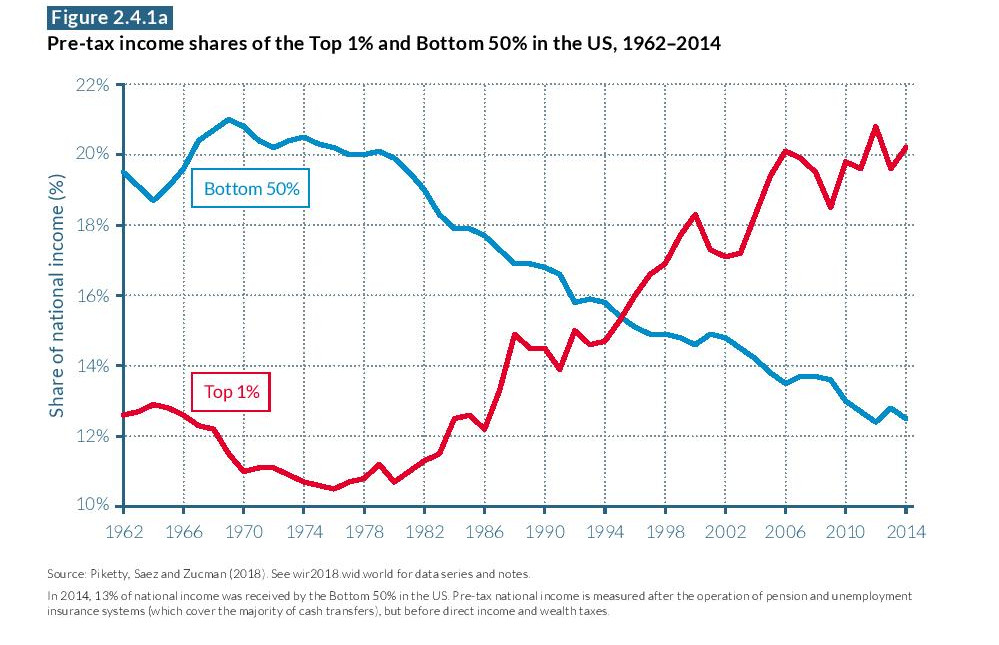

2.4 Income inequality in the United States

- Income inequality in the United States is among the highest of all rich countries.

The share of national income earned by the top 1% of adults in 2014 (20.2%) is much

larger than the share earned by the bottom 50% of the adult population (12.5%).

- Average pre-tax real national income per adult has increased 60% since 1980, but it

has stagnated for the bottom 50% at around $16 500. While post-tax cash incomes of

the bottom 50% have also stagnated, a large part of the modest post-tax income growth

of this group has been eaten up by increased health spending.

- Income has boomed at the top. While the upsurge of top incomes was first a laborincome

phenomenon in 1980s and 1990s, it has mostly been a capital- income phenomenon

since 2000.

- The combination of an increasingly less progressive tax regime and a transfer

system that favors the middle class implies that, even after taxes and all transfers,

bottom 50% income growth has lagged behind average income growth since 1980.

- Increased female participation in the labor market has been a counterforce to

rising inequality, but the glass ceiling remains firmly in place. Men make up 85% of

the top 1% of the labor income distribution.

Income inequality in the United States is among the highest of rich

countries

In 2014, the distribution of US national income exhibited extremely high

inequalities. The average income of an adult in the United States before accounting

for taxes and transfers was $66 100, but this figure masks huge differences in the

distribution of incomes. The approximately 117 million adults that make up the bottom

50% in the United States earned $16 600 on average per year, representing just onefourth

of the average US income. As illustrated by table 2.4.1, their collective

incomes amounted to a 13% share of pre-tax national income. The average pre-tax

income of the middle 40%--the group of adults with incomes above the median and below

the richest 10%, which can be loosely described as the "middle class"--was roughly

similar to the national average, at $66 900, so that their income share (41%) broadly

reflected their relative size in the population. The remaining income share for the

top 10% was therefore 47%, with average pre-tax earnings of $311 000. This average

annual income of the top 10% is almost five times the national average, and nineteen

times larger than the average for the bottom 50%. ...

Income is very concentrated, even among the top 10%. For example, the share of

national income going to the top 1%, a group of approximately 2.3 million adults who

earn $1.3 million on average per annum, is over 20%--that is, 1.6 times larger than

the share of the entire bottom 50%, a group fifty times more populous. The incomes of

those in the top 0.1%, top 0.01%, and top 0.001% average $6 million, $29 million, and

$125 million per year, respectively, before personal taxes and transfers.

As shown by Table 2.4.1 , the distribution of national income in the United States in

2014 was generally made slightly more equitable by the country's taxes and transfer

system. Taxes and transfers reduce the share of national income for the top 10% from

47% to 39%, which is split between a one percentage point rise in the post-tax income

share of the middle 40% (from 40.5% to 41.6%) and a seven percentage point increase

in the post-tax income share of the bottom 50% (from 12.5% to 19.4%). ...

National income grew by 61% from 1980 to 2014 but the bottom 50% was shut off

from it

Income inequality in the United States in 2014 was vastly different from the levels

seen at the end of the Second World War. Indeed, changes in inequality since the end

of that war can be split into two phases, as illustrated by Table 2.4.2 . From 1946

to 1980, real national income growth per adult was strong--with average income per

adult almost doubling-- and moreover, was more than equally distributed as the

incomes of the bottom 90% grew faster (102%) than those of the top 10% (79%).

However, in the following thirty-four-year period, from 1980 to 2014, total growth

slowed from 95% to 61% and became much more skewed.

The pre-tax incomes of the bottom 50% stagnated, increasing by only $200 from $16 400

in 1980 to $16 600 in 2014, a minuscule growth of just 1% over a thirty-four-year

period. The total growth of post-tax income for the bottom 50% was substantially

larger, at 21% over the full period 19802014 (averaging 0.6% a year), but this was

still only one-third of the national average. Growth for the middle 40% was weak,

with a pre-tax increase in income of 42% since 1980 and a post-tax rise of 49% (an

average of 1.4% a year). By contrast, the average income of the top 10% doubled over

this period, and for the top 1% it tripled, even on a post-tax basis. The rates of

growth further increase as one moves up the income ladder, culminating in an increase

of 636% for the top 0.001% between 1980 and 2014, ten times the national income

growth rate for the full population.

The rise of the top 1% mirrors the fall of the bottom 50%

This stagnation of incomes of the bottom 50%, relative to the upsurge in incomes

experienced by the top 1% has been perhaps the most striking development in the

United States economy over the last four decades. As shown by Figure 2.4.1a , the

groups have seen their shares of total US income reverse between 1980 and 2014. The

incomes of the top 1% collectively made up 11% of national income in 1980, but now

constitute above 20% of national income, while the 20% of US national income that was

attributable to the bottom 50% in 1980 has fallen to just 12% today. Effectively,

eight points of national income have been transferred from the bottom 50% to the top

1%. ... This has increased the average earnings differential between the top 1% and

the bottom 50% from twenty-seven times in 1980 to eighty-one times today.

Excluding health transfers, average post-tax income of the bottom 50% stagnated

at $20,500

The stagnation of incomes among the bottom 50% was not the case throughout the

postwar period, however. The pre-tax share of income owned by this chapter of the

population increased in the 1960s as the wage distribution became more equal, in part

as a consequence of the significant rise in the real federal minimum wage in the

1960s, and reached its historical peak in 1969. These improvements were supported by

President Johnson's "war on poverty," whose social policy provided the Food Stamp Act

of 1964 and the creation of the Medicaid healthcare program in 1965.

However, the share of both pre-tax and post-tax US income accruing to the bottom 50%

began to fall notably from the beginning of the 1980s, and the gap between pre-tax

and post-tax incomes also diverged significantly from this point onwards. Indeed, the

data indicate that virtually all of the meager growth in the real post-tax income of

the bottom 50% since the 1970s has come from Medicare and Medicaid. Excluding these

two health care transfers, the average post-tax income of the bottom 50% would have

stagnated since the late 1970s at just below $20 500. The bottom half of the US adult

population has therefore been effectively shut off from pre-tax economic growth for

over forty years, and the increase in their post-tax income of approximately $5,000

has been almost entirely absorbed by greater health-care spending, in part as a

result of increases in the cost of healthcare provision.

...

Taxes have become less progressive over the last decades

The progressivity of the US tax system has declined significantly over the last few

decades, as illustrated in Figure 2.4.6 . The country's macroeconomic tax rate (that

is, the share of total taxes in national income including federal, state, and local

taxes) increased from 8% in 1913 to 30% in the late 1960s, and has remained at the

latter level since. Effective tax rates have become more compressed, however, across

the income distribution. In the 1950s, the top 1% of income earners paid 40%--45% of

their pre-tax income in taxes, while the bottom 50% earners paid 1520%. The gap in

2014 was much smaller. In 2014, top earners paid approximately 30%35% of their

income in taxes, while the bottom 50% of earners paid around 25%.

...

In contrast to the overall fall in tax rates for top earners since the 1940s, taxes

on the bottom 50% have risen from 15% to 25% between 1940 and 2014. This has been

largely due to the rise of payroll taxes paid by the bottom 50%, which have risen

from below 5% in the 1960s to more than 10% in 2014.

...

Transfers essentially target the middle class, leaving the bottom 50% with little

support in managing the collapse in their pre-tax incomes

While taxes have steadily become less progressive since the 1960s, one major

evolution in the US economy over the last fifty years has been the rise of

individualized transfers, both monetary and in-kind. Public-goods spending has

remained constant, at around 18% of national income, but transfers--other than Social

Security, disability, and unemployment insurance, which are already included in

calculations of pre-tax income--increased from around 2% of national income in 1960

to 11% in 2014. The two largest transfers were Medicaid and Medicare, representing 4%

and 3%, respectively, of national income in 2014. Other important transfers include

refundable tax credits (0.8% of national income), veterans' benefits (0.6%), and food

stamps (0.5%).

Perhaps surprisingly, individualized transfers tend to target the middle class.

Despite Medicaid and other means-tested programs which go entirely to the bottom 50%,

the middle 40% received larger transfers in 2014 (totaling 16% of per-adult national

income) than the bottom 50% of Americans (10% of per-adult national income). ...

These transfers have been key to enabling middle-class incomes to grow, as without

them, average income for the middle 40% would not have grown at all between 1999 in

2014. By contrast, transfers have not been sufficient to enable the incomes of the

bottom 50% to grow significantly and counterbalance the collapse in their pre-tax

income.

The reduction in the gender wage gap has been an important counterforce to rising US

inequality

The reduction in the gender gap has been an important force in mitigating the rise in

inequality that has largely taken place after 1980. ...The overall gender gap has

been almost halved over the last half-century, but it has far from disappeared. ...

Still, considerable gender inequalities persist, particularly at the top of the labor

income distribution, as illustrated by Figure 2.4.9 . In 2014, women accounted for

close to 27% of the individuals in the top 10% of the income distribution, up 22

percentage points from 1960. Their representation, however, grows smaller at each

higher step along the distribution of income. Women make up only 16% of the top 1% of

labor income earners (a 13 percentage point rise from the 1960s), and only 11% of the

top 0.1% (an increase of 9 percentage points). There has been only a modest increase

in the share of women in top labor income groups since 1999. The glass ceiling is

still far from being shattered.

AfricaFocus Bulletin is an independent electronic publication providing reposted

commentary and analysis on African issues, with a particular focus on U.S. and

international policies. AfricaFocus Bulletin is edited by William Minter.

AfricaFocus Bulletin can be reached at africafocus@igc.org. Please write to this

address to suggest material for inclusion. For more information about reposted

material, please contact directly the original source mentioned. For a full archive

and other resources, see http://www.africafocus.org

|