|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Africa/Global: Tax Avoidance 101

AfricaFocus Bulletin

August 12, 2019 (2019-08-12)

(Reposted from sources cited below)

Editor's Note

Aircastle Ltd., a Connecticut-based global company specialized in

leasing airplanes, is not alone among large American companies

lowering their taxes through creative accounting, which also

include well-known giants such as Amazon and Apple.

But the recent revelations on Aircastle´s use of Mauritius as a

tax haven provide a helpful window into how such tax dodges can

make use of off-shore companies set up primarily for that purpose.

An AfricaFocus Bulletin sent out earlier today, and available at

http://www.africafocus.org/docs19/iff1908a.php) featured

#MauritiusLeaks, the revelations published last month by the

International Consortium of Investigative Journalists (ICIJ) based

on the leak of more than 200,000 documents from the Mauritius

office of a prestigious offshore law firm, Conyers Dill & Pearman

This AfricaFocus Bulletin goes beyond the news to provide analysis

on the policy implications, which apply more generally than the

role of Mauritius or the particular companies exposed in the ICIJ

investigation.

First, AfricaFocus summarizes the case of Connecticut-based

Aircastle Ltd. as a useful case study of how such tax avoidance

schemes work. Also included are a brief summary from ICIJ on

#MauritiusLeaks, and an analysis from the Tax Justice Network in

London on the implications for international regulation of tax

treaties and tax havens.

Other links helpful as background include a ICIJ explanation of what a tax treaty is and why they matter, and an

article from the Institute for Strategic Studies in South Africa on

the debate in Mauritius about its economic policy and relationship to other African countries

in particular.

For previous AfricaFocus Bulletins on tax justice and illicit

financial flows, visit

http://www.africafocus.org/intro-iff.php

++++++++++++++++++++++++++++++++++++++++++++++++++

Break from Publication

Note to readers: AfricaFocus Bulletin will be taking a break

from publication for a few weeks, resuming in early to mid-

September. The AfricaFocus website and Facebook pages will continue

to be updated during the break.

++++++++++++++++++++++end editor's note+++++++++++++++++

|

Tax Avoidance 101: The Aircastle Model

Aircastle Ltd. is not a household name, but if you have flown on

South African Airways, KLM, or any of more than 80 other airlines,

you have probably traveled on an airplane the Connecticut-based

company owns and manages. The company´s business model is based on

buying, selling, and leasing airplanes worldwide. Its corporate

structure minimizes the payment of taxes using a complex

arrangement of subsidiaries, all managed from Connecticut, Ireland,

or Singapore.

These arrangements, recently highlighted in the

#MauritiusLeaks investigation by the International Consortium

of Investigative Journalists (ICIJ), are legal. But they have

allowed the company to pay minimal taxes, including no corporate

taxes in the United States on income from their aircraft leases.

Aircastle, of course, is not alone among large American companies

lowering their taxes through creative accounting, which include

well-known giants such as Amazon and Apple.

But the recent revelations on Aircastle´s use of Mauritius as a

tax haven provide a helpful window into how such tax dodges can

make use of off-shore companies set up primarily for that purpose.

Getting to zero with tax avoidance became even easier with the new Republican tax cuts in

2017, but Aircastle was already well on the way to that

objective.

Aircastle´s headquarters is located at 201 Tresser Boulevard in

Stamford, Connecticut, in an office building also

housing the headquarters of Purdue Pharma.

For example, when Aircastle decided to do business in South Africa

in 2010, as the ICIJ and Quartz Africa

revealed in July 2019, it turned to a Bermuda-based law firm to

assist it in setting up six subsidiaries in Mauritius: Thunderbird

1 Leasing Ltd, and five other companies named Thunderbird 2

through 6 respectively. As was Aircastle´s common practice, in

principle each company was to own a specific aircraft. South

African Airways made their payments for the leases to the

subsidiaries in Mauritius, each of which was owned by an Aircastle

subsidiary in Bermuda or Delaware.

Since South Africa and Mauritius have a tax treaty allowing this,

taxes were paid to Mauritius at the low Mauritius rates on the

income from the leases ($772,735.60 a month for the first A300-200

leased by South African Airways from Thunderbird 1 beginning in

2011). From 2011 through 2014, according to documents leaked to

ICIJ, Thunderbird 1 paid $382,600 in Mauritius taxes, a 1.59% tax

rate on $24 million in operating profits. Aircastle paid no taxes

on these profits either in South Africa or in the United States.

According to ICIJ, “Had Aircastle’s Thunderbird 1 company alone

reported the profits it made in Mauritius over four years in the

U.S., it could have paid more than $5 million. Those taxes would

just about cover the state of Connecticut’s current budget for

domestic violence shelters.” Including other Thunderbird companies

as well, Quartz calculated, Aircastle paid $1.5 million in

Mauritius taxes on profits of $53 million, at an effective rate of

2.87%, thus avoiding $14.8 million in taxes if taxes had been paid

to South Africa. This is equivalent to more than half the annual

social housing budget of Johannesburg.

Aircastle did not respond to queries from ICIJ or Quartz, and data

for a more comprehensive analysis of the company´s tax strategy is

therefore not available. However, since it is registered on the New

York Exchange and also traded on NASDAQ, its reports to the

Securities and Exchange Commission are available. Its annual report to investors for 2018, for example,

incorporates the 10-K report to the SEC.

There we learn that Aircastle Ltd is actually incorporated in

Bermuda and thus pays no U.S. corporate income tax, except on the

management services supplied by its U.S. subsidiary to the

aircraft-owning companies. Bermuda has no corporate income tax. Thus, notes the

company in its 10-K report, under the heading “risks related to

taxation”:

“If Aircastle were treated as engaged in a trade or business in

the United States, it would be subject to U.S. federal income

taxation on a net income basis, which would adversely affect

our business and result in decreased cash available for

distribution to our shareholders.”

Given the lack of transparency in corporate reporting, it is hard

to tell how Aircastle´s strategies compare to those used by other

companies. The Institute on Taxation and Economic Policy (ITEP)

reported in April, based on10-Ks submitted to the SEC, that sixty of the Fortune 500

companies had zero or negative federal income tax payments in 2018

. But more detailed analysis or estimates of tax revenue lost,

in the United States and other countries, requires much more data

than provided in almost all such reports.

The fundamental step needed to make accountability feasible is public country-by-country reporting, by which

corporations would be required to provide for investors and the

public a breakdown of revenues, profits, employees, and taxes paid

by every country in which they do business. Both governments,

investors, and even some businesses are increasingly accepting the

need for such reports.

According to a report in April from the

U.S.-based Financial Accountability and Corporate Transparency

(FACT) Coalition, however, the trend is in the right direction.

“The evidence suggests we are quickly reaching a turning point,”

said Christian Freymeyer, researcher and author of the report.

“Investors see the value, policymakers see the benefits, and

businesses see the inevitability of greater transparency. It’s only

a matter of time before tax transparency is accepted and expected

of financial disclosure.”

Freymeyer´s analysis may well err on the side of optimism, given

the continued opposition from those with vested interests in tax

avoidance. But it is certainly true that the argument is now

finding new supporters far beyond the circle of tax justice

activists who have been the leaders in demanding these reforms.

*******************************************************************

International Consortium of Investigative Journalists

July 23, 2019

https://www.icij.org/investigations/mauritius-leaks/

Mauritius Leaks is a cross-border investigation into how one law

firm on a small island off Africa’s east coast helped companies

leach tax revenue from poor African, Arab and Asian nations.

Led by the International Consortium of Investigative Journalists,

the investigation is a collaboration by 54 journalists in 18

countries.

More than 200,000 documents from the Mauritius office of a

prestigious offshore law firm, Conyers Dill & Pearman, are at the

heart of the investigation. ICIJ corroborated company information

from the leaked documents with data in the Mauritius corporate

registry and the Financial Services Commission’s register of

licensees.

The documents offer a rare window into corporate tax avoidance in

countries in Africa, the Middle East and Asia.

The documents include emails, contracts and business plans provided

by some of the world’s biggest players in finance and law,

including KPMG and the London-based multinational law firm Clifford

Chance.

Together, they reveal attempts by corporations and individuals to

exploit tax rules that allow them to avoid taxes of such countries

as Egypt, Mozambique and Thailand.

“Mauritius is a bit like the Luxembourg of Africa,” said Tove

Ryding, policy and advocacy manager for tax justice at the European

Network on Debt and Development. Mauritius has “specialized as a

gateway to Africa so we see a lot of corporations that come and set

themselves up in Mauritius because it allows them to transfer money

in and out Africa without incurring much tax.”

Conyers sold its Mauritius business to three former employees in

2017.

Conyers told ICIJ that it “strictly adheres to the laws of all the

jurisdictions in which we operate and is routinely reviewed by

regulatory authorities and external auditors.”

Mauritius Leaks exposes how anti-poverty crusader Bob Geldof’s

investment fund and household-name corporate titans such as Wal-

Mart and Whirlpool discussed taxes and trusts as part of operations

in Africa and Asia.

Known as the “

Mauritian miracle,” the island’s economic success has

been built on offering investors tax advantages through a Mauritian

“double-whammy.”

Offshore firms such as Conyers sell the former French colony,

population 1.265 million, as the go-to-destination for

multinational corporations seeking to create shell companies

easily.

Many of those creations are what is known as “shell” or “brass

plate companies,” with no employees or offices and whose only

tangible link to Mauritius is a postal address shared by dozens or

even hundreds of similar firms.

Mauritius allows multinationals to route investments through

“resident” shell companies, which pay an effective corporate income

tax rate of 3% or less, to avoid paying substantially higher taxes

in other countries.

The second part of the “double whammy” is an array of what are

known as double tax treaties with countries in South Asia,

Southeast Asia, the Middle East and Africa.

Such treaties are intended to ensure that multinational

corporations are not taxed on the same income twice. But every

year, the world’s poorest countries lose billions of dollars as

those firms use treaties and other loopholes to route money through

shell companies in tax havens.

Mauritius rejects criticism of its role as a tax revenue haven, but

it has responded to increased pressure and introduced stricter

rules to prevent tax abuse.

At the same time, the country is pursuing more than a dozen new tax

treaties, involving some of the world’s poorest countries, and it

is resisting pleas from countries such as Uganda to overhaul their

tax treaties.

The team behind the international investigation included the

Quartz AI Studio,

which helped mine the documents through the use of machine

learning, a type of artificial intelligence.

#MauritiusLeaks primer: What to know about corporate tax

haven Mauritius

https://www.taxjustice.net/2019/07/23/mauritiusleaks-primer-what-

to-know-about-corporate-tax-haven-mauritius/

The ICIJ’s

MauritiusLeaks has produced a series of revelations about the

behaviour of international investors using the law firm Conyers

Dill & Pearman in Mauritius, typically to hold their assets in

other countries across Africa. But why Mauritius? Here we set out

the key features of this small island in the Indian Ocean.

1. Mauritius is a leading corporate tax haven

The Republic of Mauritius lies around 2,000 kilometres to the east

of Africa. A former British colony, Mauritius on its independence

in 1968 relied on sugar production. But by the late 1980s, it had

followed in the path of many UK dependencies and became

increasingly captured by the lobbyists of offshore financial

services, who bent its law and regulation to their own ends.

Mauritius ranks

14th on our recently released Corporate Tax Haven Index, because despite being a small player globally, its policies

are very aggressively focused on undermining corporate taxation in

other countries by attracting profit shifting.

Researchers at the International Monetary Fund estimate that the

global revenue losses due to profit shifting amount to around $600

billion each year. We estimate a slightly more conservative $500

billion a year. The key drivers are the “conduit jurisdictions”

such as Mauritius, that make themselves attractive for investors

and multinational companies to shift profits out of the places

where they actually make money.

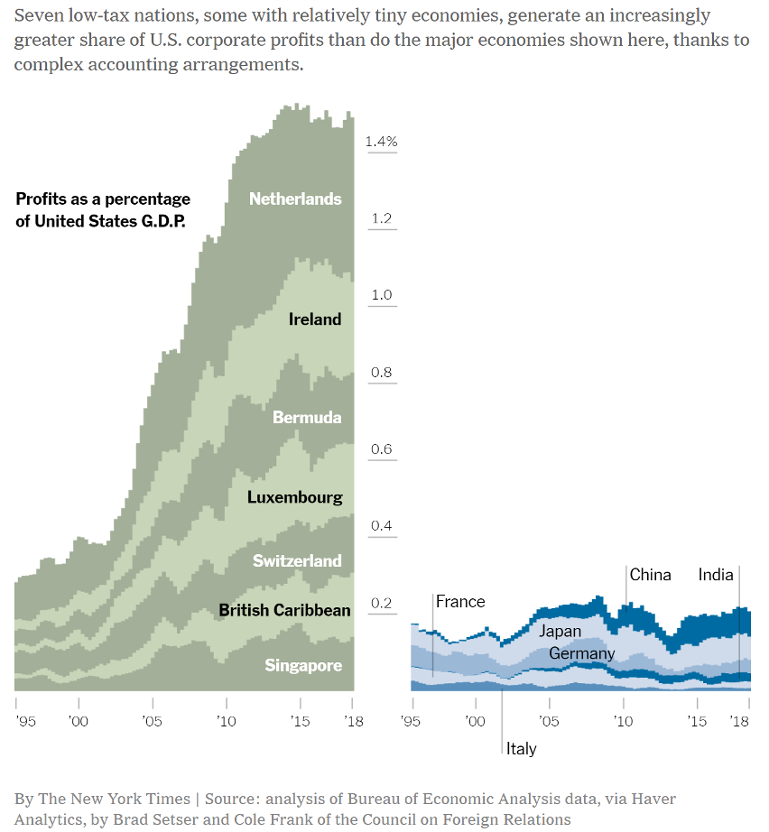

Graph on left from: Where

American Profits Hide, New York Times, Feb. 6, 2019

2. Mauritius is among the most aggressive corporate tax havens

towards African countries

An important element in corporate tax havenry is the establishment

of a network of bilateral tax treaties with other countries, which

can reduce their ability to levy corporate tax before the profits

are shifted away. The lower are the agreed rates of withholding

tax, the less revenue a treaty partner can expect to hold onto.

Our research shows that the France and the

UK have the most aggressive tax treaty networks worldwide, pushing

treaty partners to accept worse terms. But in Africa, it is the

United Arab Emirates and Mauritius which have the most aggressive

treaty networks, and hence Mauritius is responsible for large

revenue losses across the continent, as foreign investors channel

their holdings in African countries through the island.

Following the publication of the Corporate Tax Haven Index in May

2019, the Senegalese government cancelled its tax treaty with

Mauritius in June 2019.

3. Mauritius is one of the most financially secretive jurisdictions

in the world

The provision of financial secrecy is central to “tax haven”

success. This is the secrecy that allows the ownership of

companies, trusts and foundations to be anonymous. That means, the

holders of foreign bank accounts need not worry about information

being provided to their home tax authorities, or that company

accounts are hidden. The Financial Secrecy Index measures these

policy failings and more, and Mauritius obtains an overall secrecy score

of 72 out of 100 – one of the highest.

But Mauritius only ranks 49th on the Financial Secrecy Index,

globally, because the volume of financial services that it provides

to non-residents is relatively small in the grand scheme of things.

4. Globally, Mauritius is a small player and should not be singled

out. Global solutions are needed.

In terms of corporate tax havens, the dominant players are UK

overseas territories the British Virgin Islands, Bermuda and the

Cayman Islands, followed by the leading European jurisdictions the

Netherlands, Switzerland and Luxembourg. Among financial secrecy

jurisdictions, Switzerland, the United States and the Cayman

Islands dominate.

And so putting Mauritius up against a wall will not deliver the

progress needed. Instead, raising global standards is key. We

propose a UN tax convention which would require all jurisdictions

to deliver, at a minimum, the ABC of tax transparency:

-

Automatic exchange of tax information between jurisdictions, to end

the scourge of bank secrecy – and fully multilateral, as opposed to

the OECD Common Reporting Standard which systematically excludes

most lower-income countries.

-

Beneficial ownership transparency – public registers of the real

owners, as standard for companies, trusts and foundations.

-

Country by country reporting, publicly, by multinational companies

to reveal misalignments between the location of their real economic

activity, and where they declare their profits for tax purposes.

In addition, the current reform process for international tax rules

must ensure, finally, that profits are apportioned between

countries according to the location of real activity – that is,

where companies have their employment and where their sales take

place. At a stroke, this would eliminate much of the current

incentives for profit shifting that Mauritius and other conduit

jurisdictions exploit.

As immediate steps, African governments should consider revoking

abusive tax treaties with Mauritius, the UAE, and other

jurisdictions that consistently undermine their corporate tax base.

Mauritius should take the leaks as a last, clear signal: if it

wants to be seen as a responsible neighbour in the world, rather

than damaging all around it, the island must act now.

A win for Kenyans in keeping more revenues from bilateral treaties

Tax Justice Network Africa

https://taxjusticeafrica.net

Press Release, March 15, 2019

[Background paper by TJN-A from 2018 available here.]

Nairobi March 15, 2019, The Kenya High court today declared void

and unconstitutional the Double Tax Avoidance Agreement (DTAA)

between Kenya and Mauritius. In reading the Judgment, Justice W.

Korir granted Tax Justice Network Africa’s (TJNA) submission by

declaring void Legal Notice No. 59 of 2014 which renders the

Kenya/Mauritius DTAA void and unconstitutional. The long-awaited

judgement is in reference to TJNA’s challenge of the

onstitutionality of the Kenya-Mauritius DTAA signed in May 11, 2012

on the following grounds:

• The government failed or neglected to subject the Kenya-Mauritius

Double Taxation Avoidance Agreement to the due ratification process

in line with the Treaty Making and Ratification Act 2012 as a

contravention of Articles 10 (a), (c) and (d) and 201 of the

Constitution of Kenya

• That Legal Notice Legal Notice 59 of 2014 is therefore invalid

and that the Cabinet Secretary for Treasury should immediately

commence the process of ratification in conformity with the

provisions of the Treaty Making and Ratification Act 2012.

The high court ruled that due process as laid out in the Kenya

Constitution was not followed and hence the Kenya Mauritius DTA

‘ceased to have effect and became void in accordance

with the Kenyan law.’

Mr Alvin Mosioma the Executive Director of TJNA said ‘This ruling

is ground breaking not just for Kenya but other African countries.

We welcome this ruling as a validation of our argument that

requires all DTAA’s to be subject to the constitutionally required

ratification process as enshrined on Articles 10 (a to c) and 201

of the Constitution of Kenya. The ruling is a first step in the

right direction in ensuring proper and wider stakeholder

consultations on matters of national interest.’ This judgment

validates our call for African countries to review all their tax

treaties particularly those signed with tax havens. Evidence has

shown that contrary to their objectives, these DTAs have led to

double non-taxation and resulted to massive revenue

leakage for African countries. The ruling further underscores our

position that DTAs signed especially with tax havens have been

avenues of tax avoidance practices denying African countries the

much sought-after revenues to finance development.

TJNA’s Policy Lead-Tax and Investments, Jared Maranga said of the

ruling ‘’This ruling affects not only the Kenya Mauritius DTA, but

also has legal implications for all other treaties signed under the

Constitution. It rightly pushes us to rethink the costs, benefits

and motivations around signing DTAs in the first place. We should

therefore set up a DTA policy framework – which sets out the basic

minimums the country should consider while signing bilateral tax

agreements.

Double Tax Agreements have a direct bearing to the taxing rights of

states. The governments should therefore put in place mechanisms to

ensure effective public participation as part of the treaty

ratification process.”

TJNA calls on the Kenya government to revisit all other recently

signed DTAs including those with UAE, Netherlands, China and South

Korea and those under negotiation to ensure that they are compliant

with this new ruling. The role of parliament is not only critical

but also constitutionally mandatory in the treaty ratification

process. We call upon the Kenyan parliament to rise us to this

opportunity and play their legislative role in scrutinising future

DTAs to ensure that they do not undermine domestic resource

mobilisation efforts. DTAs that are not well thought out have been

a subject of abuse by multinational corporations especially through

treaty shopping and round tripping which impact on the revenues

that countries realise out the associated investments.

“TJNA intends to ensure that all recently signed treaties and

future similar tax negotiations are consistent with this ruling and

are not in contravention with the laid down laws and procedures”

added Mr Mosioma.

For more information please contact Farah Nguegan on

fnguegan@taxjusticeafrica.net ,Tel: +254 754 526126

AfricaFocus Bulletin is an independent electronic publication

providing reposted commentary and analysis on African issues, with

a particular focus on U.S. and international policies. AfricaFocus

Bulletin is edited by William Minter.

AfricaFocus Bulletin can be reached at africafocus@igc.org. Please

write to this address to suggest material for inclusion. For more

information about reposted material, please contact directly the

original source mentioned. For a full archive and other resources,

see http://www.africafocus.org

|