|

Get AfricaFocus Bulletin by e-mail!

Format for print or mobile

Africa/Global: Cutting the Costs on Remittances

AfricaFocus Bulletin

May 13, 2019 (2019-05-13)

Reposted from sources cited below)

Editor's Note

“Some people use their savings to start a business, while others

turn to family and friends to borrow cash. But Ismail Ahmed’s case

was more unusual. He launched WorldRemit, a money transfer

business, with compensation cash he received after uncovering

alleged corruption at the UN. … Ahmed had waited four years since

he’d submitted the dossier alleging corruption to the UN. But the

wait proved worthwhile when in February 2010 he received £200,000

in compensation for the way he had been treated after making

allegations, the money he used to fund the launch of WorldRemit.” -

Guardian, January 20, 2017

WorldRemit grew slowly in the first few years, but since 2014 it

has attracted significant investment. And, more important, it has

built one of the most flexible and cost-effective platforms for

money transfer, particularly to African countries, and, most

recently, between African countries as well. By focusing on digital

transactions, it has provided both greater security and efficiency,

allowing senders to use credit and debit cards as well as links to

bank accounts and mobile phone apps, and receivers, depending on

the country, to get bank transfers, cash, mobile money such as

m-pesa, and mobile phone airtime payments.

I first learned of WorldRemit when trying to find a way to

contribute to a local volunteer group in Maputo, Mozambique, that

was mobilizing support for relief from the cyclone in Beira (and

now, as well, in Cabo Delgado). Using my local bank in Washington,

DC, was, I knew by experience, both very time-consuming and costly.

But signing up for WorldRemit was easy and the process quick and

not costly. I was further impressed when WorldRemit announced that

the company itself was contributing $25,000 to the Mozambican Red

Cross.

Remittances, I already knew, were rapidly growing in Africa and

around the world, surpassing official development assistance in

amounts received by development countries. But in researching this

story, I also learned, for example, that among the highest rates in

the world were between South Africa and many of its neighbors, and

was told by a friend in Johannesburg that WorldRemit was really the

only practical way she had found to send funds home to Mozambique.

[For earlier AfricaFocus Bulletins on remittances, see

http://www.africafocus.org/docs14/remi1404.php and

http://www.africafocus.org/docs15/som1502.php]

Thus, this Bulletin, which includes an email interview with a

South-Africa-based representative of WorldRemit, as well as

additional background and excerpts from the most recent World Bank

report on remittances. The most striking statistic is that average

costs for remittances worldwide are at 7%, and for sub-Saharan

Africa 9%. Targets for supporting development are 3%, but costly

and inconvenient transfers through banks, Western Union, and other

transfer agents keep the price up. In country after country,

World Remit shows up with the lowest or next-to-lowest rates among

providers, as one can check in on-line databases such as

https://www.monito.com/ or, for a

smaller number of countries, https://remittanceprices.worldbank.org/en.

Review of WorldRemit

https://www.monito.com/en/send-money-with/worldremit

WorldRemit is also aggressively pursuing new customers. And if you

use this link (https://www.worldremit.com/en/r/WILLIAMM1241) to

sign up, and send an initial transfer of $100 or more, both you and

AfricaFocus get a discount of $20 on a future transfer. For my

part, I will use my discounts for future contributions to local

recovery efforts in Mozambique.

If you do use WorldRemit, or have experiences with other companies

that you think are as good or even better for transferring funds to

family or friends in African countries, please share your thoughts

with me by email at africafocus@igc.org

For previous AfricaFocus Bulletins on the economy and development,

visit http://www.africafocus.org/econexp.php For previous

AfricaFocus Bulletins on migration and related issues, visit

http://www.africafocus.org/migrexp.php

++++++++++++++++++++++end editor's note+++++++++++++++++

Interview by Email with WorldRemit

May 2, 2019

Many thanks to Akinyi Ochieng, Corporate Communications Manager for

WorldRemit, based in London, for arranging this interview. Ms.

Ochieng is also a prolific writer on a wide range of Africa-related

topics (http://www.akinyiochieng.com/). The questions below were

answered by Andrew Stewart, Managing Director, Middle East and

Africa, based in WorldRemit´s Johannesburg office.

AF (AfricaFocus): Can you tell me in a few paragraphs what are the

main reasons WorldRemit was needed as an alternative to Western

Union and other large companies, and why you think it is making a

contribution to African development?

WR (WorldRemit): WorldRemit is a leader in the move from offline to

digital money transfers. Along with the convenience this brings,

our cashless model on the sending side makes us more secure and

provides a digital footprint to deal with global compliance

requirements.

Africa is WorldRemit’s largest market, and we are currently present

in over 40 African markets and are expanding rapidly, driven by key

partnerships with local correspondents, our low fees, and our

mobile-first approach. We have regional offices in Senegal, Egypt,

Kenya, Tanzania, Uganda, Ethiopia, and South Africa. As Africa is

our largest market globally we are keen to continue expanding our

operations across the region.

According to the World Bank, remittances to sub-Saharan Africa grew

to $37.8 billion in 2017, according to the World Bank and are

forecast to hit around $39.2 billion for 2018 and $39.6 billion in

2019. WorldRemit is ensuring that Africans in the diaspora can make

the most of the opportunities they have and send a greater share of

their money home. Our recent research

(http://educationmatters.worldremit.com) shows that if all

remittances globally were sent digitally, it could unlock $825m for

education worldwide--a shift that would have an outsize effect in

Africa, which is home to large numbers of out-of-school children.

AF: Can you expand on the obstacles to lowering the high cost of

remittances to Africa, and how WorldRemit can afford to offer lower

rates?

WR: The vast majority of remittances today are still sent offline

at corner shops and bricks-and-mortar money transfer agents. People

in the diaspora have to find the time in their busy lives (many

working multiple jobs), to visit a money transfer agent during

business hours and then pay extortionate fees to send money home.

However our cashless model significantly reduces cost on the

sending/pay-in side as well as providing convenience.

For example, South Africa is the most expensive G20 country to send

money from with an average cost of over 15% for sending $200 - more

than double the global average (https://remittanceprices.worldbank.org/ - direct URL:

http://tinyurl.com/yxfsysfq). In Zimbabwe and Mozambique, two of

the top remittance destinations from South Africa, however,

WorldRemit fees are below 4% of the transaction cost on average.

AF: How many countries in Africa can one send remittances to

through WorldRemit?

WR: You can reach over 40 countries across the continent, including

Ghana, Kenya, Nigeria, Zimbabwe, and more. Most of our customers

choose to send via smartphone, and over 90% of all transactions are

authorized in less than 10 minutes.

Sunday morning in Nairobi Credit: Fiona Graham / WorldRemit.

AF: I first learned of WorldRemit through trying to find a way to

send funds to Mozambique for Cyclone Idai, and I later saw that

WorldRemit itself contributed $25,000. Do you have statistics on

how many people sent funds to people or organizations in the

affected countries through WorldRemit in the weeks after the

Cyclone hit Mozambique, Zimbabwe, and Malawi?

WR: The flow of remittances is 3 times bigger than official

development aid, but in the West we often only talk about the aid

given by donor countries. When a natural disaster occurs, or in

times of economic or political upheaval, remittances - the money

sent by a resident of one country to a person elsewhere in the

world - can provide immediate financial assistance to those who

need it most. Remittance flows are a significant source of income

flowing directly into people’s household incomes, while also

supporting broader development goals.

Unfortunately we don’t have statistics on this as relates to

Cyclone Idai, but to maximise the diaspora’s contributions to their

communities back home in times of urgent need, we have set up

donation matching schemes to the Red Cross. In September 2018, in

the wake of Typhoon Mangkhut, we matched donations made through our

service to the Philippines Red Cross. In October, we matched

donations to the Indonesian Red Cross after the devastating

earthquake and tsunami.

AF: What are your projections of growth for WorldRemit in terms of

market percentage compared to companies such as Western Union?

WR: Of the $700 billion dollars that are sent by migrants every

year, the majority are still sent in cash over the counter or at

high street agents. Western Union and MoneyGram – two of the

biggest names in the industry – account for less than 20% of market

share and a growing share is moving online. The arrival of digital

technology means more people are sending large sums of money

through cheaper and more secure methods such as WorldRemit, and the

number of people sending is also projected to grow due to the rapid

rise in the number of migrants from 173 million

(http://tinyurl.com/y53joqgk) to nearly 250 million

(http://tinyurl.com/y9bz22z5) in the last 20 years.

AF: Given how much cheaper World Remit seems to be over other

transfer mechanisms, what are some of the barriers you have to

overcome to reach more people?

WR: WorldRemit has launched inter-African payments, enabling

customers in Africa to send as well as receive money transfers to

145 markets. To do this, we are getting licenses for receive

countries to become send countries: we recently launched Somaliland

and South Africa as send countries. This is especially important

from the point of view of customers sending within Africa, because

Sub-Saharan Africa remains the most expensive regions to send

remittances to, with an average cost of 9.4 percent

(http://tinyurl.com/ycxlwuxk) for sending $200, according to the

World Bank. This is part of our vision to stimulate growth and

trade within the continent, led by a cashless model. In each new

sending country, WorldRemit must secure local licenses but as we

secure these in more African countries we’ll be poised to tap into

the future of growth across the Global South.

AF: What measures do you take to avoid the use of WorldRemit for

money laundering, and to identify and screen out suspicious

transactions?

WR: The need for alternatives to offline, agent-based money

transfers is growing in large part due to fraud risks, high costs

and inconvenience. Consider the challenges in this process – you

stand in line at an agent store, fill out paper forms and hand over

your payment in cash. The potential for human error is vast and it

takes months before the paper trail is put together and potential

fraud can be investigated. Online money transfers can mitigate

against some of the risks involved with cash-based remittances. The

electronic footprint online transfers leave acts as a strong

deterrent to criminal groups. Beyond fraud, online money transfers

can improve speed and convenience for users, as well as lowering

costs.

When we started back in 2010, we were one of the first businesses

to set up an entirely online remittance service. We determined that

the only way to meaningfully reduce the challenges of money

laundering and terrorist financing was to bring remittances out of

the traditional cash and paper-based models and into the online

world.

As compliance is an inherent part of our platform, we have spent

time and capital building our digital compliance system. We have

developed a sophisticated model supported by machine learning with

multiple stages of identity checks.

Emma Featherstone, Interview with WorldRemit founder Ismail Ahmed

Guardian, Jan. 20, 2017

[Excerpt only. Full article at http://tinyurl.com/he9caeb]

Some people use their savings to start a business, while others

turn to family and friends to borrow cash. But Ismail Ahmed’s case

was more unusual. He launched WorldRemit, a money transfer

business, with compensation cash he received after uncovering

alleged corruption at the UN.

Ahmed, who grew up in Somaliland, a breakaway part-desert territory

that declared independence from Somalia in 1991, became interested

in the money transfer industry after realising how many people

relied on it. Studying economics in the UK he learned the

industry’s nuances.

He then helped to run a money transfer project as part of the

United Nations Development Programme (UNDP), aiming to make a

positive difference in a sector that’s vulnerable to crime. But

Ahmed discovered alleged corruption in the UN’s Somalia remittance

programme and confronted his boss. “My boss said if I went and

submitted the dossier, I would never be able to work in remittances

again, and I took that threat very seriously. I lost my job to

uncover the fraud.”

Undeterred by the spectre of a ruined professional reputation, and

having left the UN, Ahmed set about realising his ambition to start

a mobile money transfer business. “While I was fighting for [my

case] at the UN, I was also studying at the London Business

School.”

During this time, he came up with a business plan for WorldRemit,

which was first launched as AfricaRemit. It would offer a service

for migrant workers to send money to countries across the world

using just a smartphone and app. The service would cut out the

middleman – the agents needed to deal out the money.

By December 2009 Ahmed was ready to register the business. So it

was timely that in the same month he was notified of the UN’s

decision: “I received the letter from the UN ethics committee mid-December

and a few days later I incorporated the company.”

Ahmed had waited four years since he’d submitted the dossier

alleging corruption to the UN. But the wait proved worthwhile when

in February 2010 he received £200,000 in compensation for the way

he had been treated after making allegations, the money he used to

fund the launch of WorldRemit.

More at http://tinyurl.com/he9caeb

Migration and Remittances: Recent Developments and Outlook

Migration and Development Brief 31

World Bank, April 2019

http://tinyurl.com/y4aajnsj

Summary

This Migration and Development Brief provides updates on global

trends in migration and remittances and validates the projections

made in the previous Brief in December 2018. It highlights

developments related to migration-related Sustainable Development

Goal (SDG) indicators for which the World Bank is a custodian:

increasing the volume of remittances as a percentage of gross

domestic product (GDP) (SDG indicator 17.3.2), reducing remittance

costs (SDG indicator 10.c.1), and reducing recruitment costs for

migrant workers (SDG indicator 10.7.1). It also presents recent

developments on the Global Compact on Migration (GCM).

Remittance trends.

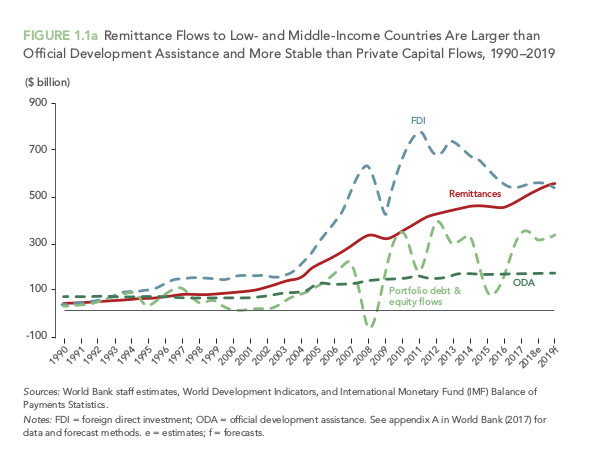

In 2019, annual remittance flows to low- and middle-income

countries (LMICs) are likely to reach $550 billion. That would make

remittance flows larger than foreign direct investment (FDI) and

official development assistance (ODA) flows to LMICs. In 2018,

remittance flows to LMICs reached $529 billion, an increase of 9.6

percent over 2017. Remittance flows grew in all six regions,

particularly in South Asia (12.3 percent) and Europe and Central

Asia (11.2 percent). Growth was driven by a stronger economy and

employment situation in the United States and a rebound in outward

flows from some Gulf Cooperation Council (GCC) countries and the

Russian Federation.

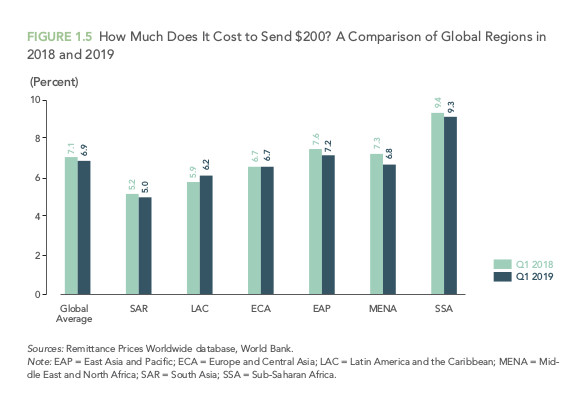

Remittance costs.

The global average cost of sending remittances remained at about 7

percent in the first quarter of 2019, roughly the same level as in

recent quarters, according to the World Bank’s Remittance Prices

Worldwide database. The cost of sending money to Sub-Saharan Africa

was 9.3 percent, significantly higher than the SDG target of 3

percent. Banks were the costliest channel for transferring

remittances, at an average cost of 10.9 percent. De-risking by

international correspondent banks—that is, the closing of bank

accounts of money transfer operators (MTOs) to avoid rather than

manage the risk in their efforts to comply with anti–money

laundering and countering financing of terrorism (AML/CFT)

norms—has affected remittance services and may have prevented

further reduction in costs.

Also, in an apparent example of policy incoherence, remittance

costs tend to include a premium, that is a cost mark-up, when

national post offices have exclusive partnership arrangements with

a dominant MTO. This premium averages 1.5 percent of the cost of

transferring remittances worldwide and is as high as 4.4 percent in

the case of India, the largest recipient of remittances. Opening up

national post offices, national banks, and telecommunications

companies to partnerships with other MTOs could remove entry

barriers and increase competition in remittance markets.

…

1.Global Remittance Flows and Migration-Related Sustainable

Development Goals

1.1 Remittances Accelerated in 2018

Remittance flows to low- and middle-income countries (LMICs) grew

by 9.6 percent in 2018 (up from the 8.8 percent rise in 2017), to

reach a record $529 billion (table 1.1 and figure 1.1a). The rise

in remittances was driven by higher growth in the United States and

a rebound in remittances outflows from some Gulf Cooperation

Council (GCC) countries and the Russian Federation.

Remittances are now the largest source of foreign exchange earnings

in the LMICs excluding China. They are more than three times the

size of official development assistance (ODA). Moreover, since

foreign direct investment (FDI) has been on a downward trend in

recent years, remittances reached close to the level of FDI flows

in 2018. Excluding China, remittances were significantly larger

than FDI flows (figure 1.1b).

…

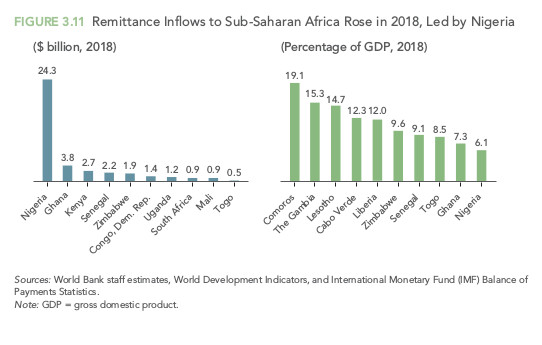

3.6 Remittances to Sub-Saharan Africa Continued to Accelerate in

2018

Remittance trends.

Remittances to Sub-Saharan Africa were estimated to grow by 9.6

percent from $42 billion in 2017 to $46 billion in 2018.

Projections indicate that remittances to the region will keep

increasing, but at a lower rate, to $48 billion by 2019 and to $51

billion by 2020. The upward trend observed since 2016 is explained

by strong economic conditions in the high-income economies where

many Sub-Saharan African migrants earn their income.

Nigeria, the largest remittance-recipient country in Sub-Saharan

Africa and the sixth largest among LMICs, received more than $24.3

billion in official remittances in 2018, an increase of more than

$2 billion compared with the previous year (figure 3.11). Looking

at remittances as a share of GDP, Comoros has the largest share,

followed by the Gambia, Lesotho, Cabo Verde, Liberia, Zimbabwe,

Senegal, Togo, Ghana, and Nigeria.

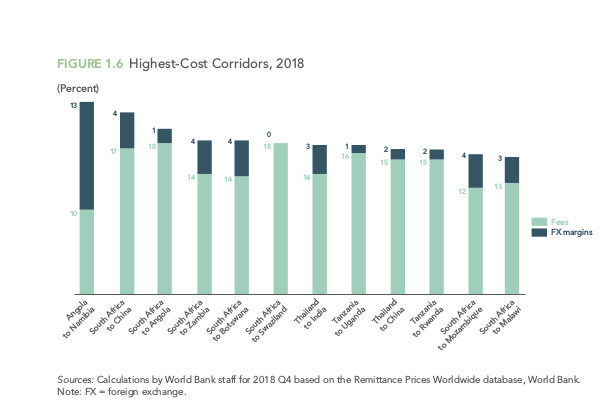

Remittance costs.

The cost of sending $200 to the Sub-Saharan African region averaged

9 percent in 2018 Q4, almost the same as in 2018 Q3. A slight

declining trend has been observed in remittance costs in the region

since the beginning of 2018, but this remains far above the global

average of 7 percent and the SDG target of 3 percent to be achieved

by 2030.

Moreover, the regional average hides country-level variations. For

instance, in 2018, for the cheapest corridors it costs on average

3.5 percent, an amount close to the SDG 3 percent target (figure

3.12). On the other hand, for the five most expensive corridors,

mainly in the southern African subregion, the average cost was 18.7

percent, almost three times higher than the global average and six

times higher than the SDG target. The most expensive corridor

(Angola-Namibia), saw significant variation in fees from 15.8 to

22.4 percent between 2018 Q3 and 2018 Q4. This indicates that

efforts are needed to address high intraregional transaction costs

in the remittance-transmission industry.

AfricaFocus Bulletin is an independent electronic publication

providing reposted commentary and analysis on African issues, with

a particular focus on U.S. and international policies. AfricaFocus

Bulletin is edited by William Minter.

AfricaFocus Bulletin can be reached at africafocus@igc.org. Please

write to this address to suggest material for inclusion. For more

information about reposted material, please contact directly the

original source mentioned. For a full archive and other resources,

see http://www.africafocus.org

|